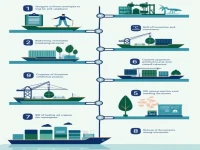

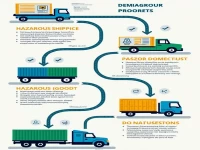

Dangerous Goods Export Certification Process Explained

The Dangerous Goods Declaration is a crucial legal requirement for the export of hazardous materials. The application process involves obtaining a packaging performance document, which includes the application for the manufacturer's code, packaging labeling, and performance testing. Various packages must pass specific performance tests to ensure safety, ultimately obtaining a qualified inspection report to facilitate a smooth application for the Dangerous Goods Declaration.